Credit Card

Apply for Chase Freedom Flex® Credit Card: Start Saving!

Interested in maximizing your credit card rewards? Discover step-by-step instructions on how to apply online and at a branch for the Chase Freedom Flex® Credit Card and enjoy intro bonus, cashback and more!

Advertisement

Make the most out of your daily purchases and save big with cashback rewards!

If you’re the type of savvy spender who doesn’t mind complex rewards that bring you generous cashback bonus, then you should apply for the Chase Freedom Flex® Credit Card!

Not a big fan of online applications? Not to worry! Since you can go to a Chase branch closest to your location and talk to a representative. Then, you can apply in person with confidence!

While this card requires you to keep track of your spending to activate categories, it offers a chance to maximize your finances. This means you’ll get rewarded every time you use your card!

And if you’re a new card member, you can also get a generous introductory bonus. So, keep reading and find out how the application process works, and start enjoying the benefits today!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

What makes the Chase Freedom Flex® Credit Card stand out

The Chase Freedom Flex® Credit Card offers a versatile rewards program with cashback varying from 1% to 5%. This means you can get money back on a variety of categories.

From groceries to gas to drugstore purchases, it’s designed to cater to a wide range of spending habits and preferences. Moreover, you can enjoy a generous sign-up bonus.

Beyond its rewards program, this card offers additional benefits to enhance your experience. Get access to travel-related perks such as trip cancellation and trip interruption insurance.

This provides peace of mind for unexpected travel disruptions. And with no annual fee, you can enjoy these benefits without worrying about recurring costs!

Application Options for the Chase Freedom Flex® Credit Card

With a combination of rewards, intro bonus, and benefits, the Chase Freedom Flex® Credit Card is the perfect choice to apply if you want to make the most out of your everyday spending!

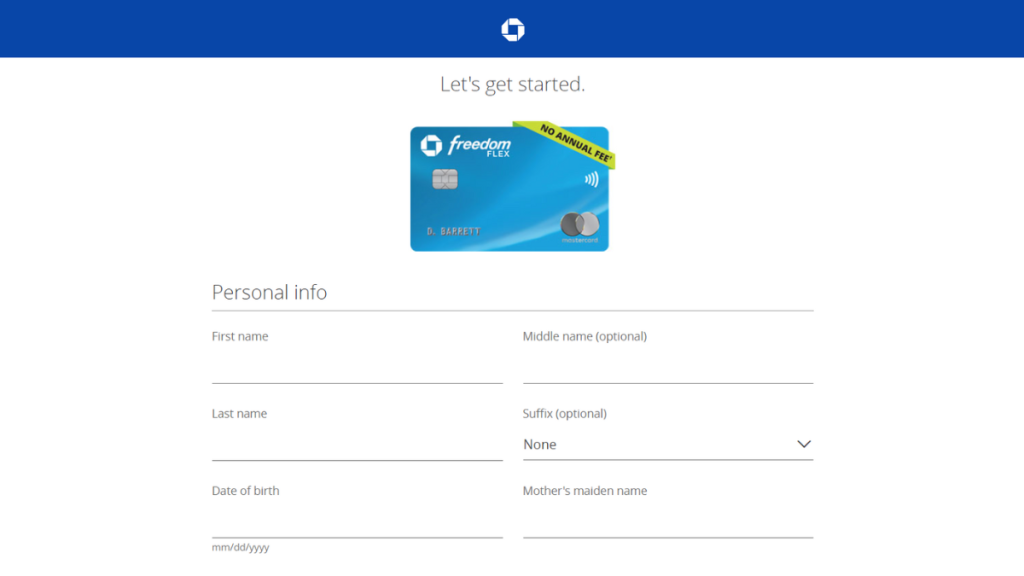

How to apply online

- Visit the bank’s website: First, go to Chase Bank’s website and click on “Credit Cards” on the main menu. Then, select the option to see personal credit cards.

- Review information: When you find the Chase Freedom Flex® Credit Card, click to review its information before you apply. Make sure this is the right card for your lifestyle.

- Start application: Then click on the “Apply Now” button and fill out the application form with the information required. When you’re done, submit the online form.

- Approval: You may receive an instant decision on your application, or Chase may need additional time to review your information. Upon approval, you’ll receive your Chase Freedom Flex® Credit Card in the mail.

How to apply in person at a bank branch

- Locate a branch: The first step is to access the Chase Bank website and locate a branch nearest you. Then, ensure that the branch offers credit card application services.

- Gather documents: Next, gather the necessary documents for the credit card application, such as identification, recent pay stubs or bank statements, and what Chase requires for a credit card application.

- Visit the branch: Upon arrival, approach a customer service representative or banker and express your interest in applying for the Chase Freedom Flex® Credit Card.

- Complete the form: Fill out the application form with accurate personal information, including your full name, address, date of birth, Social Security number, and contact information.

- Submit the form and wait for approval: When you’re done, submit the form. Once your application is submitted, wait for Chase to review your information and provide a decision. If you’re approved, you’ll also receive your Chase Freedom Flex® Credit Card in the mail.

Would you like to learn about other options? Here’s the U.S. Bank Altitude® Go Visa Signature® Card!

Finding the complex rotating rewards is not for you? Then apply for the U.S. Bank Altitude® Go Visa Signature® Card instead of the Chase Freedom Flex® Credit Card.

If you’re looking for rewards with an easier approach, this might be the best option for your lifestyle. With points on dining, groceries, and even streaming services, this card is a compelling option!

Besides, the U.S. Bank Altitude® Go Visa Signature® Card also offers a generous introductory bonus with no annual fee to worry about. So, are you interested in learning more?

Then, check out an in-depth review and get insights into the card’s rewards program, benefits, fees, and eligibility requirements. This will help you make an informed decision!

US Bank Altitude® Go Visa Signature®

Apply for the US Bank Altitude Go Visa Signature Card for a $0 ExtendPay® fee offer and a $15 streaming credit. Start saving smartly!

Trending Topics

How to Maximize Your Learning Experience in Professional Courses

Maximize learning courses with personalized frameworks, daily routines, and active participation to ensure lasting career growth.

Keep Reading

How to Refinance Your Loan for Better Terms and Rates: Refinance Loan Tips for Every Step

Explore smart refinance loan tips to save money, improve terms, and achieve long-term financial success with clear, actionable steps.

Keep ReadingYou may also like

McDonald’s is Hiring: Entry-Level Positions Starting at $10/hour

Start your career at McDonald's! Flexible hours, steady pay, and growth opportunities make it a great place to work. See how to apply today!

Keep Reading

Zelle: The Fast and Easy Way to Send Money to Your Friends

Discover the revolutionary Zelle app - a fast and easy way to send money to friends and family. Explore its features and advantages.

Keep Reading

The Benefits of Taking Online Courses for Career Advancement

Advance your career with online courses by selecting relevant programs and applying skills for real-world growth.

Keep Reading