Credit Card

American Express Platinum Card® Review: Luxury Perks!

A luxurious card with exclusive benefits that will provide you with the best experiences wherever you are. Explore over 10 different options to use credits with the American Express Platinum Card®!

Advertisement

Earn points for every dollar spent in the US and around the world with the American Express Platinum Card®!

Read our American Express Platinum Card® review, and discover what this credit card is all about! With a premium card tailored for individuals with excellent credit scores, you can indulge in various luxuries.

Apply for the American Express Platinum Card®

It's easy to apply for American Express Platinum Card® and you can earn 125,000 points after the first six months!

Every purchase becomes an opportunity to earn points, especially for those who love to travel the world! So, it’s time to closely examine the features of this card and understand why it’s one of the most luxurious.

- Credit Score: Good – Excellent;

- Annual Fee: $695;

- Purchase APR: 21.24% to 29.24%;

- Cash Advance APR: 29.99%

- Rewards: Earn 80K rewards points after spending $8K within 6 months. Plus, earn 1 to 5 points per $1 on every purchase!

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

American Express Platinum Card®: Overview

The American Express Platinum Card® is an option for those seeking exclusive advantages and are not concerned about the annual fee!

Not only does it not charge foreign fees, but the American Express Platinum Card® also offers automatic credits for various areas, including hotel bookings and airline incidental fees.

The reward bonus also caters to travel enthusiasts, as you earn 5 points per dollar spent on airline tickets or with the American Express company.

Additionally, hotel reservations through American Express Travel also earn you 5 points per dollar. In other words, this is the best way to book your trip! Plus, earn 1 point on other purchases!

Analyzing the Advantages and Drawbacks of the American Express Platinum Card®

Now, let’s dive into an American Express Platinum Card® review focused on pros and cons. This makes it easier for you to weigh all the points and decide if this card is right for you!

Pros

- Welcome bonus: One of the major highlights of the American Express Platinum Card® is the available welcome bonus. After spending a total of $8,000 in the first six months, you’ll earn 125,000 points!

- Rewards: Earn 5 points for every dollar spent on purchasing tickets and accommodations through American Express Travel. Additionally, redeem each point for 0.5 or 2 cents.

- Automatic Credits: One of the significant benefits of the American Express Platinum Card® is the over $1,500 in credits. Besides travel, you can obtain credits for Uber, Equinox gym, Saks Fifth Avenue, Clear, and even streaming services.

- Cell phone protection: This benefit protects your cell phone and covers up to $800 for one year, providing extra security for your smartphone use.

- Concierge service: You also have access to a service that provides assistance 24/7!

- Airports Lounge: Moreover, you also have access to various lounges in international airports to relax before your flights. There are more than 1,300 lounges worldwide!

Cons

- The high annual fee, reaching the astronomical value of $695, is one such drawback!

Therefore, if you’re not willing to spend a lot to enjoy various travel benefits, this card may not be the best option in the market. It’s necessary to spend significantly for it to be worthwhile!

Eligibility Requirements for the American Express Platinum Card®

You need to have at least 690 to be considered eligible to apply for the card.

Moreover, it’s essential to be over 18 years old and provide proof of your age. Among the required documents, you need to present your Social Security Number.

All applicants must be established residents of the US. Therefore, you need to provide your address and proof of residence.

Another determining factor is your monthly income and your current job position. All this information must be provided in the application.

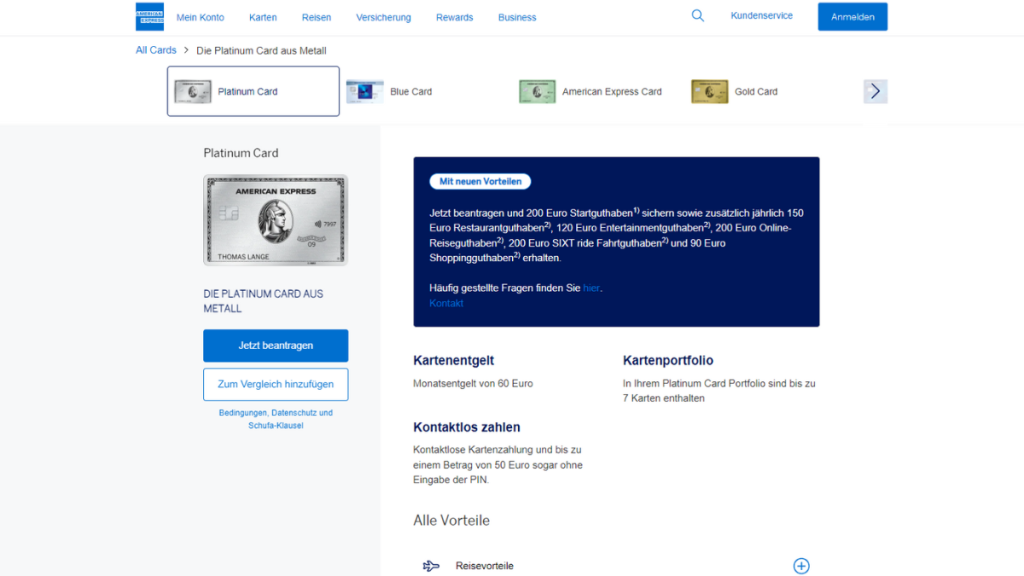

Applying for the American Express Platinum Card®: A Manual

If you want to continue your application, know that the process is straightforward and can be done entirely online.

So, check our post to find out how to join without difficulties. We provide you with a blueprint containing all the necessary information!

Apply for the American Express Platinum Card®

It's easy to apply for American Express Platinum Card® and you can earn 125,000 points after the first six months!

About the author / Pedro Saynovich

Trending Topics

US Bank Altitude® Go Visa: No Annual Fee and Excellent Rewards

Earn rewards on dining, streaming, groceries, and more with the US Bank Altitude® Go Visa Signature® Card—no annual fee, endless benefits!

Keep Reading

How to Manage Loan Repayments and Avoid Debt

Learn how to manage loan repayments effectively with budgeting, reminders, and strategies to stay motivated for financial stability.

Keep ReadingYou may also like

How to Choose a Course That Fits Your Career Path

Choose the right course career path with clear goals, personalized plans, and mentorship to drive long-term career growth and success.

Keep Reading