Credit Card

American Express Blue Business Cash™ Card Review: Enhance your business finances!

A business card could be the solution you've been waiting for to improve your company's financial situation! By utilizing exclusive benefits ranging from no annual fees to cash back, you can significantly boost your business account. Find out more!

Advertisement

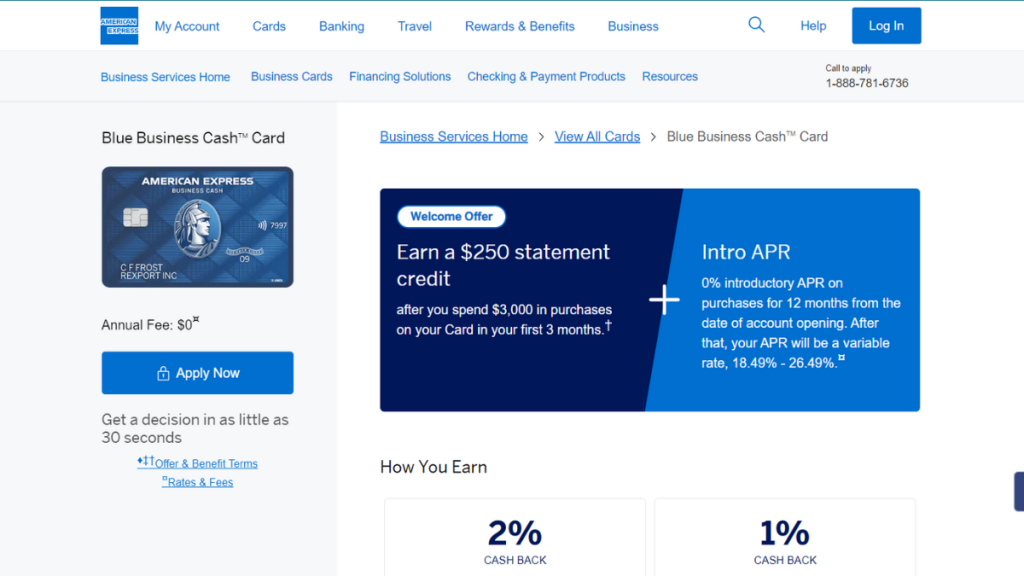

Take advantage of an intro APR at 0% with the American Express Blue Business Cash™ Card!

With the American Express Blue Business Cash™ Card review, you can learn how to make the most of this card, leveraging its advantages for your company while being mindful of any drawbacks.

Apply for the American Express Blue Business Cash™

Get a response in 30 seconds when you apply for American Express Blue Business Cash™ Card online! Earn up to 2% cash back!

Despite having no annual fee and offering cash back, the card may have other features that may not be ideal for your business. Understanding a credit card is a crucial step in optimizing your business!

- Credit Score: Good or Excellent;

- Annual Fee: $0;

- Purchase APR: 0% for the first year, after that, 18.49% to 26.49%;

- Cash Advance APR: Not available;

- Rewards: Cash back from 1% to 2% on various expenses.

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

American Express Blue Business Cash™ Card: Overview

To decide if the American Express Blue Business Cash™ Card is right for you, this review will delve into how this card functions in your daily life. The first detail is that the card is accessible.

With no annual fee and an intro APR of 0% for the first year of use, you can leverage the American Express Blue Business Cash™ Card for significant purchases without paying interest!

Additionally, you have access to an exclusive cash back plan. Any purchase made offers a 2% refund. However, once you reach $50,000 in a year, the cash back drops to 1%.

Moreover, cash back redemptions are automatic! This saves you time, and the discount is applied to your account! In other words, this is a great opportunity for businesses!

Furthermore, the card has flexibility in the credit limit. If needed, you can exceed your limit in a month, but in that case, you must pay the balance above your credit limit!

Analyzing the Advantages and Drawbacks of the American Express Blue Business Cash™ Card

Moreover, every card has pros and cons. Thus, in this American Express Blue Business Cash™ Card review, let’s explore both sides of the coin!

Pros

The cash back of up to 2% can help you save significantly on your purchases, especially considering there is no annual fee charged on the American Express Blue Business Cash™ Card!

Another positive point is that you get insurance for rental car accidents if you make the reservation with the American Express Blue Business Cash™ Card!

The flexibility of the credit limit can assist your company in months when purchases are higher than expected!

The welcome bonus for the American Express Blue Business Cash™ Card is $250 if you spend over $3,000 in the first three months of use.

Cons

On the flip side, not everything is positive in the American Express Blue Business Cash™ Card review. The main downside is that this card is not recommended for international use.

In other words, you may face difficulty using the American Express Blue Business Cash™ Card with its foreign fee and without specific travel benefits.

Moreover, the fact that the cash backdrops from 2% to 1% can be a significant disadvantage if your company consistently makes purchases exceeding $50,000! In that case, you may consider another card!

Eligibility Requirements for the American Express Blue Business Cash™ Card

Now, in this American Express Blue Business Cash™ Card review, let’s outline the key requirements to apply for the card. Firstly, it is necessary that you have an active business.

Additionally, a good or excellent credit score is required, which can be quite challenging. Nevertheless, the American Express Blue Business Cash™ Card is a card designed for small businesses!

Applying for the American Express Blue Business Cash™ Card: A Manual

Well, if you enjoyed learning about our American Express Blue Business Cash™ Card review, why not proceed and apply? You can visit the Amex website and take advantage of the application process.

Furthermore, we have prepared a post with relevant information that can help you apply! Check out our American Express Blue Business Cash™ Card blueprint and make the most of the details!

Apply for the American Express Blue Business Cash™

Get a response in 30 seconds when you apply for American Express Blue Business Cash™ Card online! Earn up to 2% cash back!

About the author / Pedro Saynovich

Trending Topics

Chime App Review: Banking with a Modern Twist

Discover Chime, the financial app that's revolutionizing the way people bank with your plethora of functionalities.

Keep Reading

Delta SkyMiles® Gold: Elevate Your Travel with Tailored Rewards

Learn about the Delta SkyMiles® Gold Card's perks, like free checked bags and travel rewards for Delta flyers.

Keep Reading