Manage your finances efficiently and gain control over your own money.

No more struggling at the end of the month! Discover the best budgeting apps

Advertisement

Have you ever imagined having all your finances organized in one convenient and accessible place? Downloading budgeting apps is the key to simplifying your financial life.

With these powerful tools, you will have full control over your expenses, be able to set clear goals, and track your progress. Don't let your finances get lost in chaos! Check out some advantages of downloading a budgeting app:

You will remain in the same website

You will be redirected to another website

You’ll receive messages for less than 1 week, with a maximum of 1 message per day. You can unsubscribe anytime by replying STOP. By submitting this form, I confirm that I am 18+ years old and agree to the Privacy Policy and Terms and Conditions. I also provide my signature, giving express consent to receive informational messages via automated emails, SMS, MMS text messages, and other forms of communication. Message frequency may vary as part of our good-faith effort to respond to your inquiry. Message and data rates may apply. Text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and that I may revoke my consent at any time.

Financial management is essential for anyone who wants to have control over their personal finances. A budgeting app can help you understand your income and expenses, identify spending patterns, and make more informed financial decisions. Check out the full content to learn more.

To achieve good financial management, it's important to have control over your expenses, create a financial plan, set goals, and track your progress. A budgeting app provides tools and resources to streamline this process, allowing you to efficiently organize your finances. Find out more in the full content.

The best budgeting app varies depending on your personal needs and preferences. There are several options available, each with specific features. That's why you should check out the full content for recommendations on popular apps.

Do you want to efficiently manage your personal finances? Budgeting apps offer features that allow you to track your expenses, categorize transactions, set financial goals, create budgets, and analyze spending patterns.

Moreover, they can provide insights into your overall financial health, helping you follow best practices in financial management and ensure that your income stays healthy.

Discover some of the functionalities of budgeting apps:

- Expense tracking: These apps allow you to record and categorize your income and expenses, providing a clear view of your cash flow.

- Financial goal setting: With these apps, you can set personalized financial goals, such as saving for a trip or paying off debts, and track your progress towards these objectives.

- Detailed analysis and reports: Budgeting apps offer detailed charts and reports, enabling you to analyze your spending, identify patterns, and areas for savings, assisting you in making smarter financial decisions.

The main objectives of budgeting apps are:

- To help you organize and manage your personal finances in one place.

- To enable tracking and control of your expenses for better analysis and financial decision-making.

- To assist users in setting financial goals and tracking their progress towards them, providing a clear view of their financial objectives.

Discover how budgeting apps can revolutionize your financial life, providing organization, control, and the ability to achieve your goals. Take advantage of these tools to build a solid financial life. Check out the full article.

Trending Topics

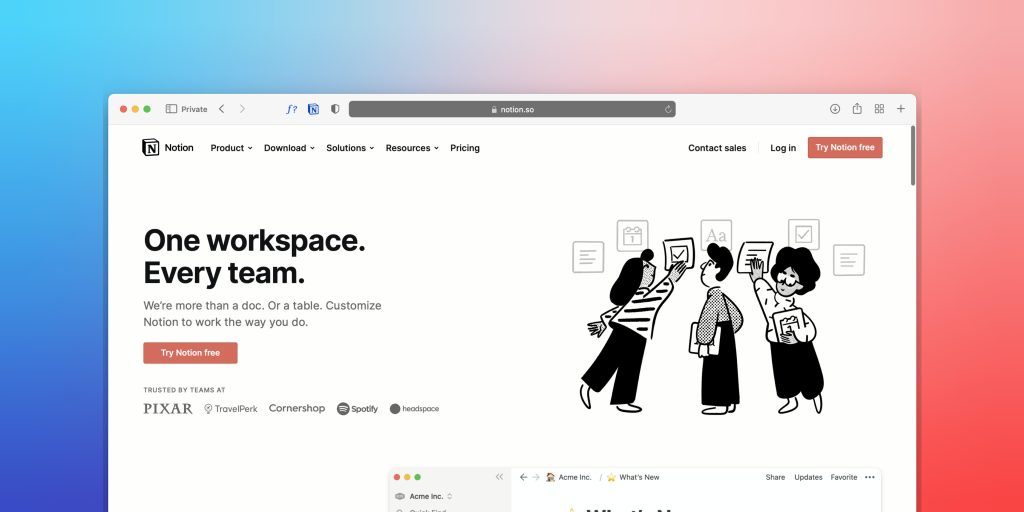

Improve your Productivity with Notion

Notion is a versatile tool that merges everyday work apps into a unified, customizable workspace. It allows you to take notes, add tasks, manage projects, and create your knowledge base, all while collaborating with your team.

Keep ReadingYou may also like

EarnIn: The Friendly Solution for Small Cash Advances

EarnIn is an innovative solution that can help many people deal with unforeseen expenses. Learn more about the app here!

Keep Reading